30+ Mortgage prepayment calculator

There are a few ways to pay off a mortgage sooner than the 30-year term. How to use the mortgage affordability calculator.

I Have Presently Have A 4 125 30 Year Mortgage And I Was Thinking About Going Into A 15 Year Mortgage At Roughtly 3 0 I Wanted To Hear Your Toughts For The

Bi-weekly payments instead of monthly payments.

. Therefore a mortgage is an encumbrance limitation on the right to the property just as an easement would be but. A mortgage calculator gives you valuable insight into what your regular payments and amortization sschedule will be in different scenarios eg different mortgage amounts different rates etc. Then enter either 1 how much you want to pay each month or 2 how long you want to make mortgage payments.

When it comes to getting a mortgage in Ontario having a reliable mortgage calculator gives you some certainty ahead of time. In the US the most common mortgage loan is the conventional 30-year fixed-interest loan which represents 70 to 90 of all mortgages. Saving 3420 in interest.

How to Pay Off a 30-Year Mortgage Faster. Recast your mortgage. At the bottom left of the calculator display click Prepayment options then add in 50 in the Monthly principal prepayment field.

For example a 30-year fixed mortgage will have a lower monthly payment than a 15-year fixed but will require you to pay more interest over the life of the loan. If you are a Scotiabank mortgage customer depending on the mortgage solution that you select each year you can increase your scheduled monthly payments by up to 10 15 or 20 of the payment initially set for your term or in some cases your current payment and make a lump sum prepayment of up to 10 15 or 20 of your original principal. Mortgage loan basics Basic concepts and legal regulation.

To use our mortgage affordability calculator simply enter your and your partners income or your co-applicants income as well as your living costs and debt. Options to pay off your mortgage faster include. The loan program you choose can affect the interest rate and total monthly payment amount.

We count the number of days left from the date of your prepayment to the maturity date and we round it down to either 30 60 or 90 days the maximum is 90 days. If you factor in other fees such as property tax insurance and PMI. Making one additional monthly payment each year.

To use the early payoff mortgage calculator simply enter your original loan amount when you first received the loan along with the date you took out the home loan. Use our free mortgage calculator to estimate your monthly mortgage payments. A 30-year mortgage comes with a locked interest rate for the entire life of the loan.

Please enter one of them Monthly payment or loan term. For this reason when they can afford it homeowners refinance their 30-year mortgage into a 15-year loan when index rates are lower. Early Mortgage Payoff Calculator.

Mortgage Prepayment Calculator to calculate early payoff for your mortgage payments based on a desired monthly payment or the number of years until payoff. Your mortgage payment is defined as your principal and interest payment in this mortgage payoff calculatorWhen you pay extra on your principal balance you reduce the amount of your loan and save money on interest. What is a 30-Year Fixed-Rate Mortgage.

The prepayment is assumed to happen before the first payment of the loan. If your mortgage has costly prepayment penalty. Redmond Homeowners May Want to Refinance at Todays Low.

Are commonly 30 years while Canadian amortization periods are usually 25 years. Mortgage terms in the US. Whats the prepayment charge for prepaying your mortgage.

Mortgage Calculator Excel spreadsheet is an advanced mortgage calculator with PMI taxes and insurance monthly and bi-weekly payments and multiple extra payments options to calculate your mortgage payments. Where the prepayment charge is an interest rate differential the calculator tool estimated tool results will be in most cases be a higher amount than the actual prepayment charge. Because the rate stays the same expect your monthly payments to be fixed for 30 years.

Then enter the loan term which defaults to 30 years. The VA loan calculator provides 30-year fixed 15-year fixed and 5-year ARM loan programs. The mortgage calculator spreadsheet has a mortgage amortization schedule that is printable and exportable to excel and pdf.

You can obtain 30-year fixed-rate loans from government-sponsored lenders private mortgage companies banks and credit unions. Use this calculator to determine your monthly mortgage payment and amortization schedule. Mortgage Prepayment Charge Calculator.

The most common mortgage terms are 15 years and 30 years. Please enter valid desire loan term between 1-30. If it does you may want to leave a small balance until the prepayment penalty period expires.

Account for interest rates and break down payments in an easy to use amortization schedule. Refinance with a shorter-term mortgage. You might not even think about trying to pay off your mortgage early.

Enter a principal amount an interest rate and the original loan term. Lower interest rates compared to 30-year terms. Extra Mortgage Payments Calculator.

Mortgage prepayment penalties are only allowed for the first three. This shortens their. Using the calculator on this page you can work out your monthly payments total interest paid as well as the impact of taking out a different size.

You may also enter 360 months for a 30-year loan or 15 years for a 15-year fixed or 180 months depending on loan type desired. For example a 30-year. According to Anglo-American property law a mortgage occurs when an owner usually of a fee simple interest in realty pledges his or her interest right to the property as security or collateral for a loan.

If you have a 30-year mortgage you can refinance to a 15-year mortgage with reduced interest. The Mortgage Payoff Calculator above helps evaluate the different mortgage payoff options including making one-time or periodic extra payments biweekly repayments or paying off the mortgage in full. Use the mortgage affordability calculator above to figure out how much you can afford to borrow based on your current situation.

Savings Total amount of interest you will save by prepaying your mortgage. Of course mortgage regulations changes from province to province so its crucial that the mortgage calculator you use is specific to where you live. If you only have a couple more years to pay.

When you sign on for a 30-year mortgage you know youre in it for the long haul. The one-year two-year three-year four-year five-year and seven-year mortgage terms. In a 30-year fixed rate mortgage the interest payment that we make is probably very close to the mortgage itself.

Moreover it allows you to shift from a fixed-rate mortgage to an adjustable-rate mortgage ARM and vice versa. For the same 200000 30-year 5 interest loan extra monthly payments of 6 will pay off the loan four. Our mortgage prepayment calculator can estimate the cost if you make prepayments or break your mortgage early.

Keep in mind that you may pay for other costs in your monthly payment such as homeowners insurance property taxes and private mortgage insurance. This calculator figures monthly mortgage payments based on the principal borrowed the length of the loan and the annual interest rate. The Mortgage Payment Calculator allows you to calculate monthly payments average monthly interest total interest and total payment.

Now add a third scenario to review. This mortgage calculator uses the most popular mortgage terms in Canada. Mortgages are how most people are able to own.

Free mortgage calculator to find monthly payment total home ownership cost and amortization schedule with options for taxes PMI HOA and early payoff. Prepayment Amount Prepayment After Month Full Amortization Table. For the exact prepayment charge and the costs associated with breaking your mortgage contract before the end of your.

Pay extra each month. How to use this mortgage prepayment calculator. For example add a third 30-year fixed-rate mortgage but this time add in a 50 per month prepayment of principal.

Refinance Mortgage Calculator Mls Mortgage Refinance Mortgage Home Refinance Free Mortgage Calculator

What Are The Pros And Cons Of Pre Closing A Home Loan Quora

Tables To Calculate Loan Amortization Schedule Free Business Templates

What Are The Pros And Cons Of Pre Closing A Home Loan Quora

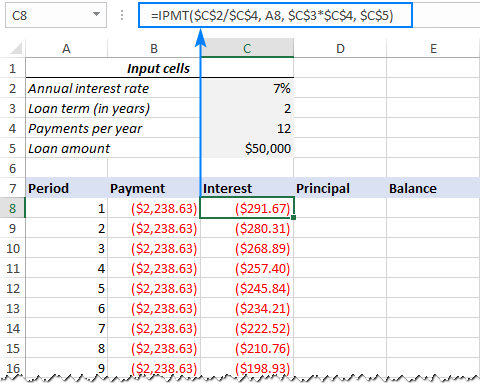

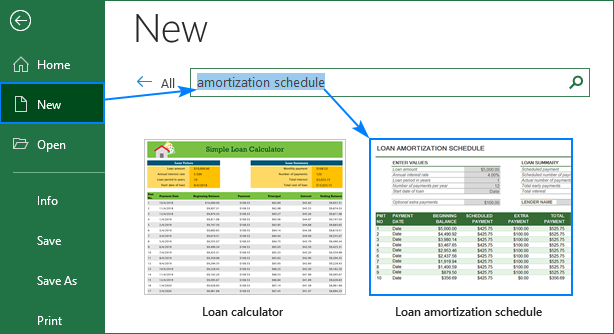

Create A Loan Amortization Schedule In Excel With Extra Payments If Needed

On A 30 Year Fixed Mortgage Would It Be Possible To Make Additional Principle Payments To End Up Paying Interest Equal To A 15 Year Mortgage Quora

Create A Loan Amortization Schedule In Excel With Extra Payments If Needed

How To Avoid Realtor Fees The Complete Guide

On A 30 Year Fixed Mortgage Would It Be Possible To Make Additional Principle Payments To End Up Paying Interest Equal To A 15 Year Mortgage Quora

Loan Emi Calculator In Excel Xls File Download Here

![]()

Hm8qvceu9nbe2m

Best 10 Mortgage Calculator Apps Last Updated September 9 2022

Create A Loan Amortization Schedule In Excel With Extra Payments If Needed

Create A Loan Amortization Schedule In Excel With Extra Payments If Needed

Best 10 Mortgage Calculator Apps Last Updated September 9 2022

Create A Loan Amortization Schedule In Excel With Extra Payments If Needed

Can The Student Loan Statute Of Limitations Get Rid Of My Private Loans Student Loan Hero