Total taxes taken out of paycheck

Ad Choose From the Best Paycheck Companies Tailored To Your Needs. For a hypothetical employee with 1500 in weekly pay the calculation is 1500 x 765 0765 for a total of 11475.

/Paycheck_AdobeStock_154492502_Editorial_Use_Only-b62ac70013ec4e13b3e2a73be5e9c239.jpeg)

Gtl Group Term Life On A Paycheck

Every employer is expected to withhold 62 percent of your gross income for Social Security up to income of 132900 for 2019.

. That would be 3600 in taxes withheld each year. If youre and both of you work calculate your spouses tax withholding too. If too much money is withheld an employee will receive a tax refund if not enough is withheld an employee will have an additional tax bill.

For instance the first 9525 you earn each year will be taxed at a 10 federal rate. From each of your paychecks 62 of your earnings is deducted for Social Security taxes which your employer matches. Each employer withholds 62 of your gross income for Social Security up to income of 132900 for 2019.

If you are self-employed you are responsible for paying the full 29 in Medicare taxes and 124 in Social Security taxes yourself. Everything from 9526 up to 38700 will be taxed at 12. Withholding from your paycheck is done on what is known as the graduated system.

The next 30249 you earn--the amount from 9876 to 40125--is taxed at 15. For a single filer the first 9875 you earn is taxed at 10. If you work for yourself you need to pay the self-employment tax which is equal to both the employee and employer portions of the FICA taxes 153 total.

4 rows How do you calculate taxes taken from your paycheck. Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes. How Much Money Gets Taken Out of Paychecks in Every State.

If you earn at least a specified amount for at least 40 quarters you can get Social Security benefits when you retire. Luckily there is a deduction to help you pay this high self. The employer portion is 15 percent and the.

The federal government requires that you pay 62 percent of your gross pay for FICA taxes and one-half of your Medicare taxes. Withhold half of the total 765 62 for Social Security plus 145 for Medicare from the employees paycheck. Luckily when you file your.

The money taken is a credit against the employees annual income tax. This is true even if you have nothing withheld for federal state and local income taxes. You pay the tax on only the first 147000 of your.

If youre single this is pretty easy. You owe tax at a progressive rate depending on how much you earn. Current FICA tax rates The current tax rate for social security is 62 for the employer and 62 for the employee or 124.

A withholding tax takes a set amount of money out of an employees paycheck and pays it to the government. And 137700 for 2022Your employer must also pay 62 percent. Add the taxes assessed to determine the.

What percentage is taken out of paycheck taxes. Simplify Your Day-to-Day With The Best Payroll Services. Only the very last 1475 you earned.

Paycheck Taxes Federal State Local Withholding H R Block

Understanding Your Paycheck

Tax Information Career Training Usa Interexchange

How To Calculate Taxes On Paycheck Store 54 Off Www Ingeniovirtual Com

Paycheck Calculator Online For Per Pay Period Create W 4

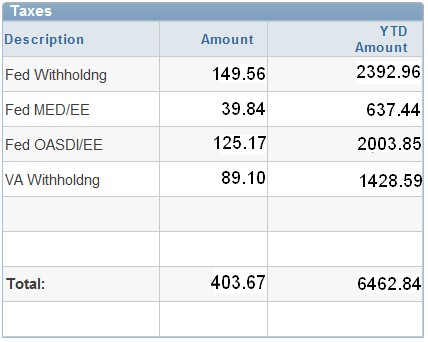

Hrpaych Yeartodate Payroll Services Washington State University

Payroll Taxes Here S A Breakdown Of What Gets Taken Out Of Your Pay And What You Are Taxed On Youtube

Understanding Your Paycheck Direct Deposit Advice Jmu

Gross Vs Net Pay What S The Difference Between Gross And Net Income Ask Gusto

Understanding Your Paycheck Credit Com

Irs New Tax Withholding Tables

Pay Stub Meaning What To Include On An Employee Pay Stub

Why Your Paychecks Might Be Bigger Right Now Nextadvisor With Time

Here S How Much Money You Take Home From A 75 000 Salary

Understanding Your Paycheck Youtube

Taxes On Paycheck Factory Sale 50 Off Www Ingeniovirtual Com

Check Your Paycheck News Congressman Daniel Webster